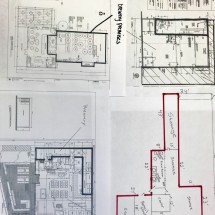

Law Offices of John P. Connell, P.C.: In every application for an alcoholic beverage license whether it be for a manufacturer, wholesaler or a retailer, a diagram of the proposed “licensed premises” will be required. Once an application is approved by the Trade & Tax Bureau (“TTB”), the Massachusetts Alcoholic Beverage Control Commission (“ABCC”) and/or a local municipal licensing authority Continue Reading...